In a recent interview with Joe Rogan, Elon Musk said, “Social Security is the biggest Ponzi scheme of all time.” This was hardly an original comment. More than a few people from all walks of life have said this over the years.

But if Social Security is a Ponzi scheme, then we certainly shouldn’t promise not to touch it. We should eliminate it. But if it’s not a Ponzi scheme, then we should not even insinuate that it is.

Long ago, con artists like Charles Ponzi figured out that they could use new investor money to pay handsome dividends to earlier investors. This would attract new investors, but it needed an ever-growing list of new investors to keep going. When the newest set of investors became too small to make all the required dividend payments, the jig was up, and the con artist would take all the money and disappear.

Here are some key attributes of all Ponzi schemes:

1. Participation is voluntary.

2. The con artist benefits from the money that victims lose.

3. Most who invest in a Ponzi scheme lose everything they invested.

But with Social Security:

1. Participation is not voluntary.

2. Those who created it don’t benefit financially from harm to those in the program.

3. Unless they die young, those in the program don’t lose everything they paid in.

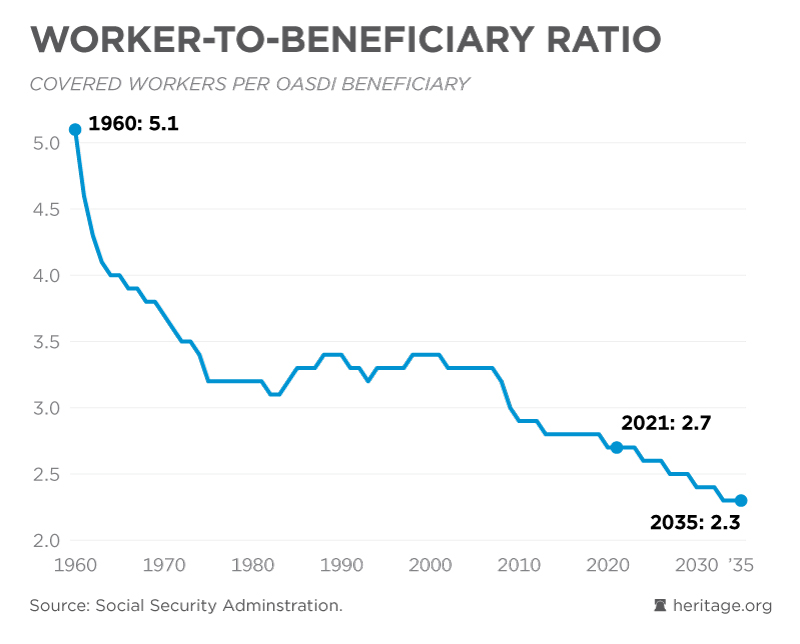

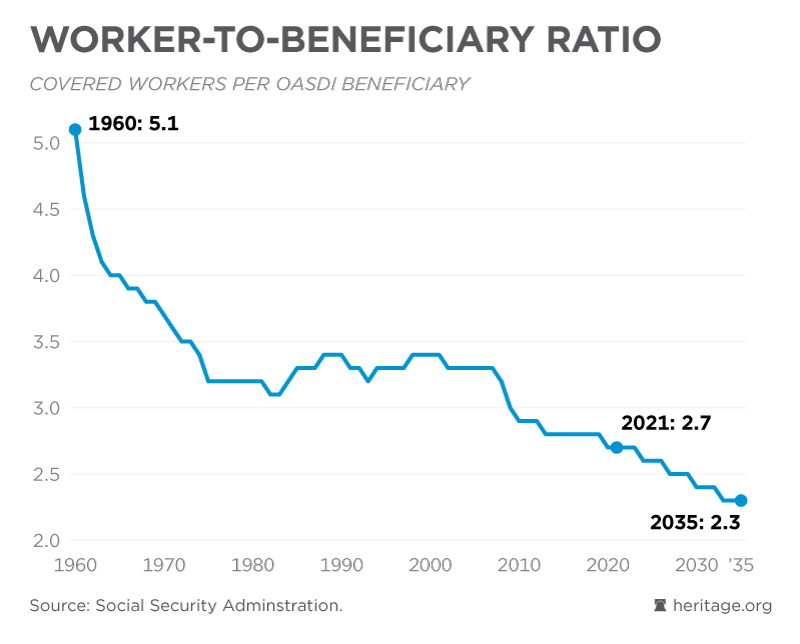

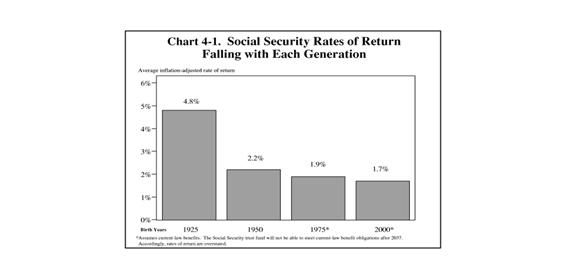

Social Security is simply not a Ponzi scheme. Those who claim that it is are likely alluding to the fact that when there are many contributors relative to the number of beneficiaries, beneficiaries can get better terms than when there are few contributors relative to beneficiaries. In the 1940s, for example, there were about 42 workers for every beneficiary. That ratio has fallen steadily over the years. Now there are about 2.6 workers for every beneficiary.

This is why the Social Security payroll tax has been increased 20 times since Social Security was created. It is also why the rate of return for all but the poorest contributors fell steadily over the twentieth century.

Younger people are not getting as good a deal as older ones, but that’s because the American population’s age distribution has changed over time. The baby boomer generation obviously presents an extraordinary challenge to the program. But the Social Security program doesn’t manipulate the population’s demographic profile.

In one important way, however, those who are cynical about Social Security are right. It takes an act of Congress to change the program in a substantive way. Politicians eager to secure votes by backing changes that made the program more generous to current voters were jeopardizing its long-term viability — an impact that would only become clear to everyone else long after their political careers were over.

But that problem is not a product of the program itself; it is a product of self-serving behavior on the part of politicians. Unfortunately, a long list of ad hoc changes to Social Security made by politicians over the years has, in one way, made the program worse than a Ponzi scheme.

Because participation is not voluntary, Social Security effectively coerces citizens into participating in a program that is cheating future generations. To ensure that politicians will keep getting votes cast by those alive today, it is increasingly cheating the unborn as baby boomers move through the system. Even though a trust fund was built up to deal with this baby boomer problem, it is filled with special securities that must be presented to the Treasury for redemption, which the Treasury can only do by issuing new debt dollar for dollar.

So, what looked like prudent savings turns out to be merely a way station to the issuance of new debt that will ultimately be paid by future generations. That new debt is on top of future unfunded liabilities. According to the most recent data from the Financial Report of the United States, as of 2024 the unfunded liability for Social Security over the next 75 years is now over a staggering 25.4 trillion dollars.

These additional layers of complexity that help hide the harm Social Security is doing to future generations can excuse uneducated voters, but it cannot excuse the politicians who created them.

Most people believe that Social Security was created with the best of intentions, but over the years it has become an apt example of the aphorism “the road to hell is paved with good intentions.” Ponzi schemes are certainly not rooted in good intentions, but at least they are not devised to fleece unborn children.