Gold has crossed $4,000 per ounce just 200 days after it passed $3,000. What began as a slow march from crisis to crisis has transformed into an accelerated sprint that is reshaping how savers, investors, and policymakers worldwide view the world’s oldest monetary metal. Beyond the simple symbolism of a round number, the current moment captures the increasingly uneasy intersection of macroeconomic stress, geopolitical instability, and feedback loops of momentum.

Several overlapping and reinforcing forces are driving gold’s surge:

- Volatile trade policies, central bank division, and persistent fiscal dysfunction have fueled demand for safe assets. The US government’s repeated shutdown standoffs and spiraling debt dynamics make gold particularly attractive as “insurance;” particularly in the current shutdown, which seems likely to endure.

- There is a tiresome critique that gold pays no dividend and has no yield, but that becomes an advantage when real (inflation-adjusted) rates turn negative. As the Federal Reserve has embarked upon an easing campaign, the opportunity cost of holding gold declines, giving the metal a fresh tailwind.

- With the US dollar sliding, gold becomes cheaper for overseas buyers and more desirable as a reserve diversifier.

- From Beijing to Brazil, central banks have been steadily adding to gold reserves. These moves are partly about diversifying away from the dollar and partly about hedging against sanctions or geopolitical shocks.

- Exchange-traded funds backed by physical gold are attracting fresh capital. Some of this is retail money, but a large portion is institutional flows — allocations made with the intention of sticking through volatility.

- Unlike oil or grain, gold production cannot be scaled quickly. Mines face capital shortages, political risk, and geological limits. Recycling adds some supply, but nowhere near enough to offset surging demand.

- Rising public debt, unconventional fiscal policies, and questions about central bank independence are corroding faith in fiat currency. Each new episode of political dysfunction adds to the case for holding tangible assets.

- For some investors, gold is not just an investment but a hedge against extreme scenarios: war, defaults, or sudden inflation spikes. These convex, “lottery ticket” flows add depth to the rally.

The result is a perfect storm of forces reinforcing one another. Gold is not rising for one reason; It is rising for many.

The temptation is usually to dwell on the neatness of round numbers: $4,000 per ounce is a record high: higher (obviously) than $3,000 per ounce with eyes already focused on $5,000 per ounce.

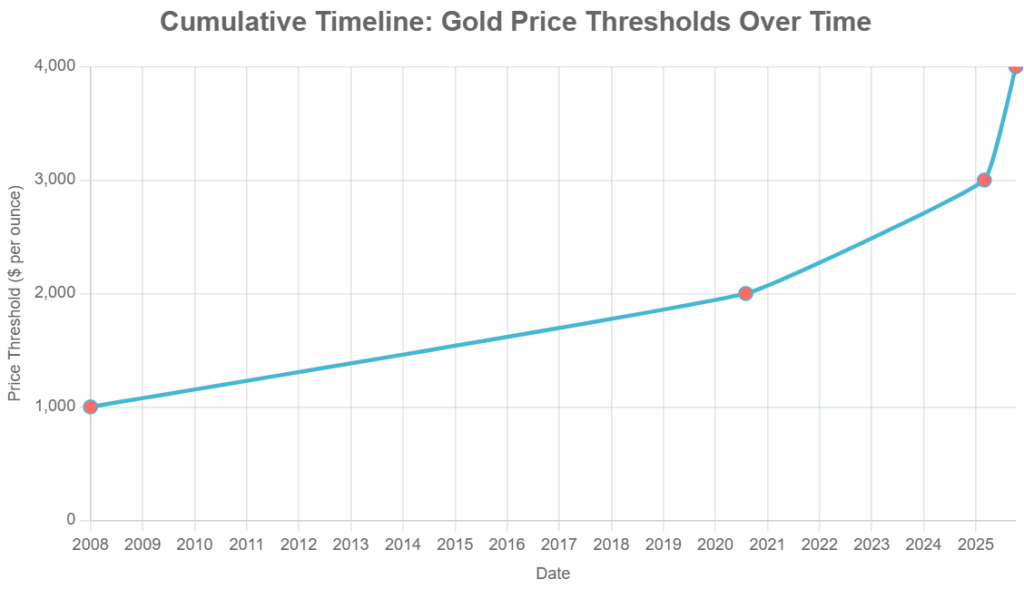

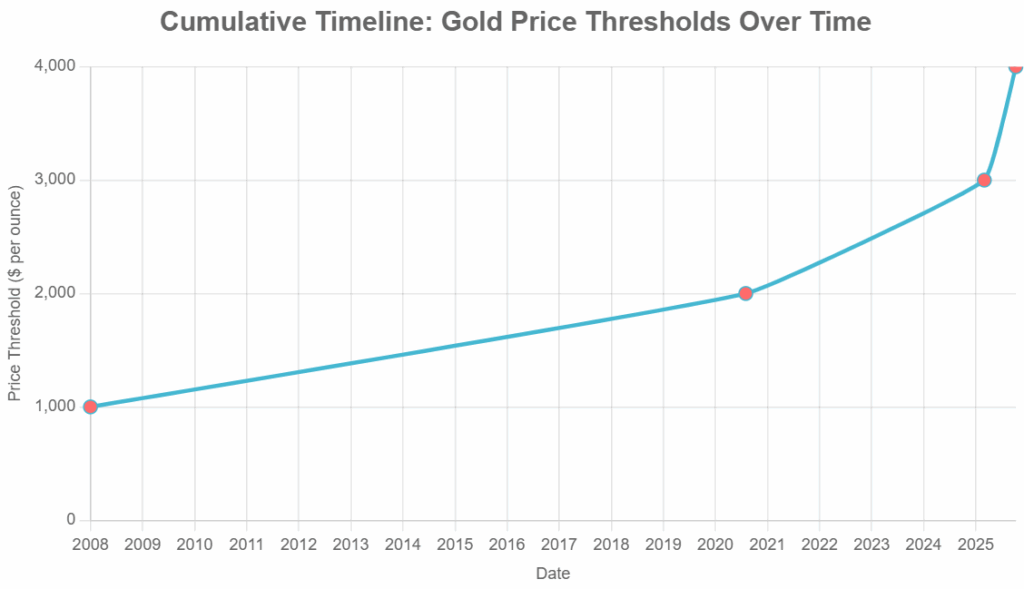

But a more revealing story emerges when we consider how quickly gold has moved between these thresholds. Gold first crossed $1,000 per ounce in 2008, during the financial crisis. It would take until August 2020 — nearly 12 years, or roughly 4,400 days — before gold finally broke through the $2,000 per ounce level. The journey from $2,000 in 2020 to $3,000 per ounce in March 2025 took about five years, or roughly 1,700 days. The latest leap has been the most astonishing. Gold cleared $3,000 per ounce in March 2025 and crossed $4,000 per ounce by October 2025. That’s a span of only about seven months (roughly 200 days).

This contraction in “days per new-thousand-dollar-ounces” is dramatic: from twelve years, to five, to less than one. It suggests a regime shift: either an accelerating loss of confidence in financial systems, or an extraordinary momentum cycle that could itself become self-reinforcing. The speed of these price leaps offers a richer narrative than psychological milestones alone. In practical terms, it raises questions: if the time to each new level is shrinking, are we watching a bubble — or are we witnessing a structural repricing of gold’s role in the financial system?

Quantifying the intervals provides an investigative framework: one can map “days per new-thousand-dollar-ounces” against macro factors such as real yields, central bank reserves, or debt-to-GDP ratios. If gold’s acceleration lines up with deteriorating fundamentals, it’s possible that the price move reflects more than momentum; it signals a profound market reassessment.

Gold at $4,000 per ounce is more than a headline. It is the sum of overlapping uncertainties: inflation, currency instability, debt, central bank policy, and geopolitical turbulence. But it is also a story told in numbers. The shrinking intervals between each successive $1,000 price gain speak both of, and to, a world that is changing faster than before. One where safe havens are sought not gradually, but urgently. It’s now quite clear that gold can reach $5,000 per ounce. The outstanding issue is how quickly it will take to do so, and what that speed tells us — if anything — about the evolving state of the global economy.